Carbon tax (CBAM) as a test of the EU's negotiating power

From 1 January 2026, the European Union will start collecting a carbon border tax on imports of goods from energy‑intensive sectors under the CBAM (Carbon Border Adjustment Mechanism). This measure applies to the import of six groups of goods that emit the most greenhouse gases during their production – electricity, iron and steel, cement, fertilizers, aluminium, hydrogen, from all third countries except imports from Iceland, Liechtenstein, Norway and Switzerland.

How the system works

After three years of a transitional phase, during which companies only had to report their emissions (submitting quarterly reports without physically paying for certificates), the mechanism enters full operation. Importers now have to purchase and surrender CBAM certificates corresponding to the CO₂ emissions associated with their exports. The price of these certificates is linked to the EU Emissions Trading System (ETS) and ranges roughly between €70–100 per tonne of CO₂.

Countries that already have their own emissions trading system can take into account the carbon tax paid in the place of their operation when paying the CBAM fee. More information can be found at:

https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

Why is the EU introducing the mechanism?

The purpose is to level the playing field between European manufacturers who pay for emissions under the EU ETS system, and foreign producers who often do not bear comparable costs.

According to UN data, heavy industry (especially steel and aluminium) represents a significant source of CO₂ emissions in the energy sector, up to 15% of the EU's total emissions. The aim of CBAM is to prevent so‑called “carbon leakage”, i.e., the relocation of production to countries with less stringent emission rules, and to create equal conditions for European and foreign manufacturers.

Like the ETS system, CBAM is intended to help the EU accelerate industrial decarbonisation by shifting the cost of emissions onto importers as well, not only onto European producers.

Criticism of the measure

Several major EU trading partners — including China, India, Russia and South Africa — have criticised the mechanism as protectionist and warn that it may be incompatible with World Trade Organization (WTO) rules.

Critics also point out that the system can be administratively complex, because accurately measuring the embedded emissions in products is challenging. Insufficient data often leads to the use of default values, which can increase costs.

In the longer term, part of the costs can be expected to be reflected in industrial input prices, and indirectly also in the prices of final goods.

What should importers do?

Companies that import selected key raw materials (steel, aluminium, cement and fertilisers) into the European Union should watch out for obligations under CBAM from the start of 2026. In practice this means the following steps:

- Verify whether CBAM actually applies to the import — i.e., go through the customs codes of the imports

- Obtain emission data from suppliers – the company must know the actual CO₂ emissions associated with the production of the imported raw material/product. If the data are not available, default values should be used, which are often significantly higher (indicating a higher tax).

- Register as a CBAM declarant with the appropriate authority (in the Czech Republic, the customs administration),

- Prepare for the purchase of CBAM certificates corresponding to CO₂ emissions, essentially the purchase of emission allowances

CBAM is one of the tools of European climate policy and also a measure that could significantly affect hundreds of companies importing key raw materials and products into the EU and the Czech Republic. It will also be very interesting to see how the EU will be able to defend and enforce this measure against its main trading partners and at what cost.

If you would like advice or direct assistance with calculating your carbon footprint, try our application at

https://app.esgrovia.cz/

or contact us at www.esgrovia.cz

Related articles

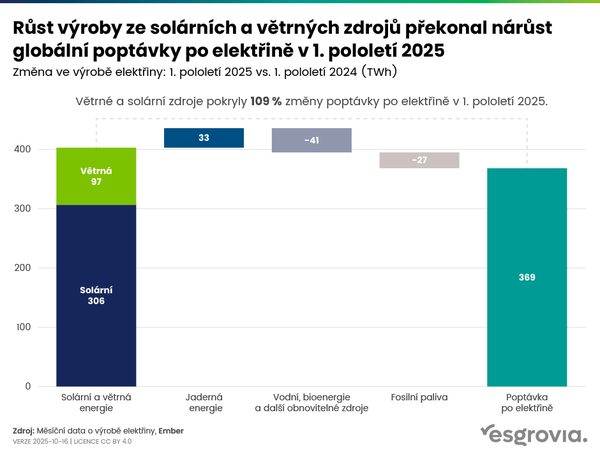

Renewable sources overtook coal as the world's leading source of electricity for the first time

Regulation of ESG ratings: after the EU, the United Kingdom is also joining with legislation

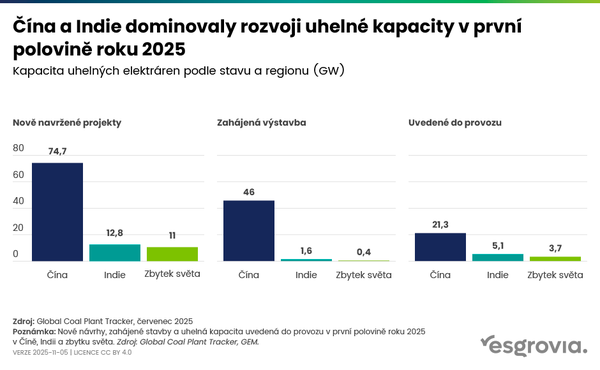

China and India account for 87% of new coal capacity in the first half of 2025