Emerging markets are driving electromobility

According to an analysis by the think tank Ember (“The EV leapfrog – how emerging markets are driving a global EV boom”), the global boom in electric vehicles is no longer driven only by Europe and China. Until recently, the transition to electromobility was described as a process led by Europe and China. Emerging economies were often seen as “catch‑up” – it was expected that they would adopt electric vehicles later, more slowly, and only when their price fell significantly. That notion, however, no longer matches reality.

The latest data from the Ember think tank show that 2025 represents a pivotal turning point – emerging markets are no longer catching up to electromobility; increasingly, they are becoming its leaders.

Electromobility has become a global phenomenon

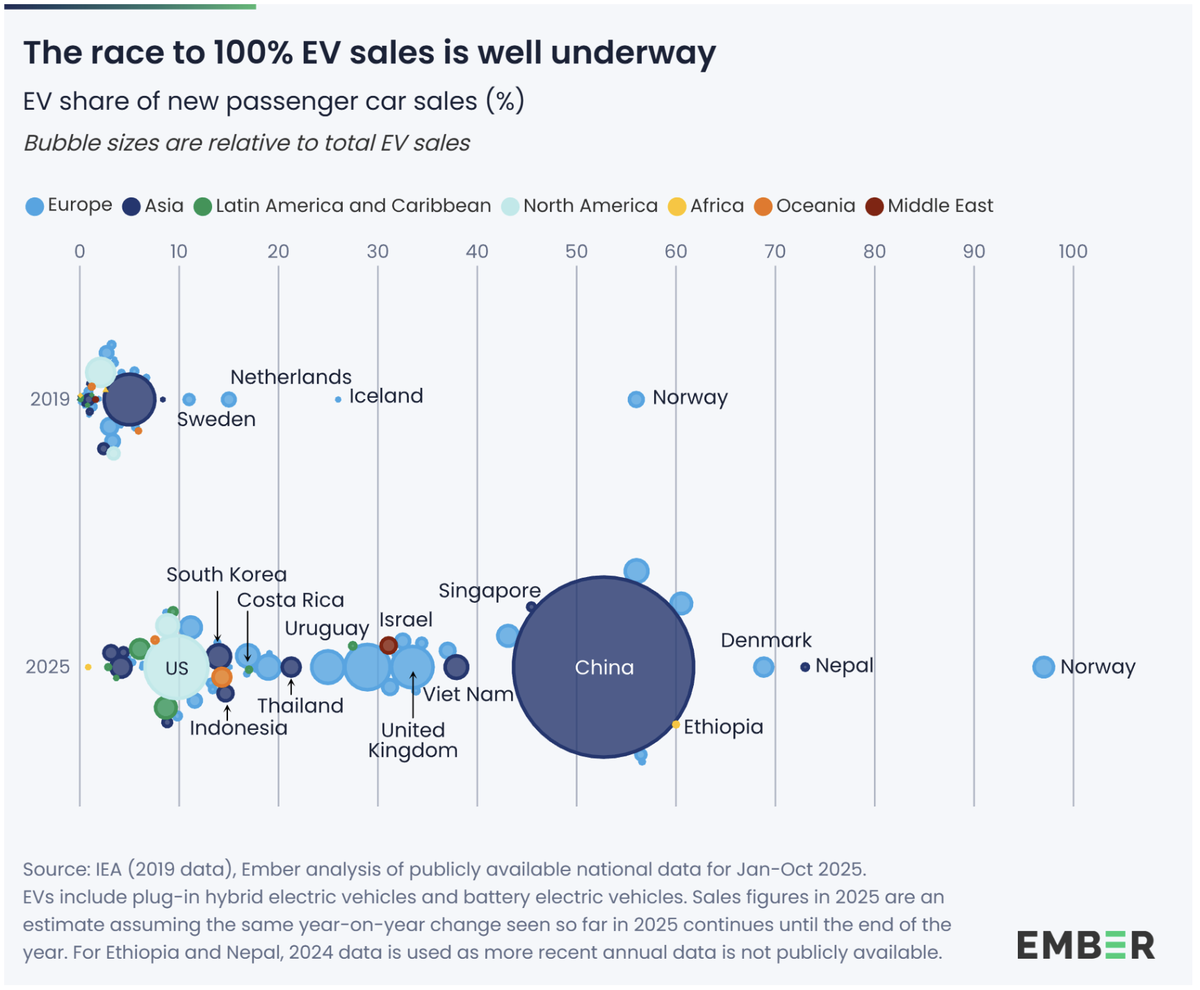

Between January and October 2025, electric cars accounted for more than a quarter of all newly sold passenger vehicles worldwide. In 2019 it was less than 3%. The crucial factor is not only the growth rate but especially the geographic distribution – 39 countries have already surpassed the 10% share of electric vehicles in new sales. And a third of them are outside Europe:

China surpassed the 50% threshold for the first time

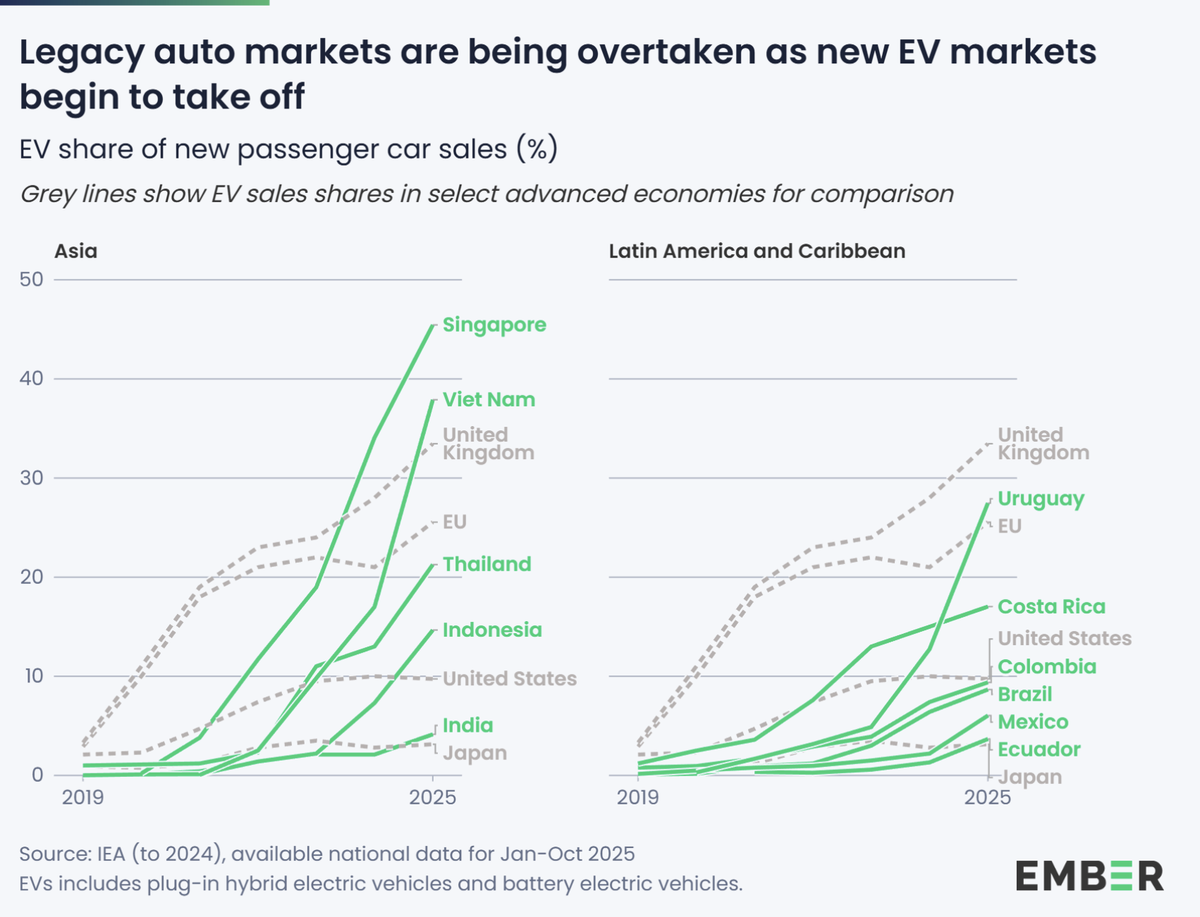

A number of emerging economies today outpace traditional automotive powers such as the USA or Japan. The center of the electromobility transformation has shifted. One of the most striking examples of so‑called “leapfrogging” is Southeast Asia:

- Vietnam reached an almost 40% share of electric vehicles in 2025 – just four years earlier it was practically zero

- Thailand surpassed the 20% mark, whereas in 2019 it was only 1%

- Singapore, Thailand and Vietnam today show a higher share of electric vehicles than the EU average

Ember claims that this is not a gradual improvement, but a structural change, supported by targeted policy, domestic production, and infrastructure development:

Vietnam is illustrative in this regard. Domestic manufacturer VinFast first built sales volumes through corporate fleets and its own charging network, then successfully moved into the consumer market. Today, three quarters of its sales are direct sales to end customers, and one of its models is the best-selling car in the country

Emerging markets are outpacing traditional automotive economies

While growth rates are stagnating in some developed countries, emerging markets continue to accelerate rapidly:

- India, Brazil and Mexico have a higher share of electric vehicles than Japan

- Indonesia overtook the USA for the first time in 2025

- Japan has been around 3% since 2022

According to Ember, the difference is mainly in political priorities. While some advanced economies are scaling back their incentives, a number of emerging states see electric mobility as a strategic tool of economic and energy policy.

Electric vehicles as a tool for economic and energy security

For developing economies, electric vehicles are not only a climate solution. They also bring reduced dependence on imported fossil fuels, improved urban air quality, and opportunities for the emergence of new industrial sectors and jobs.

For example, Indonesia and Turkey linked electric‑vehicle incentives to local‑production requirements, thereby attracting investments from vehicle and battery manufacturers.

Even more decisive steps have been taken by countries such as Ethiopia and Nepal. Ethiopia banned the import of new internal‑combustion‑engine vehicles in 2024, which led to electric vehicles accounting for roughly 60 % of new sales. Nepal reached an even higher share in 2024—76 %—mainly thanks to strong hydropower.

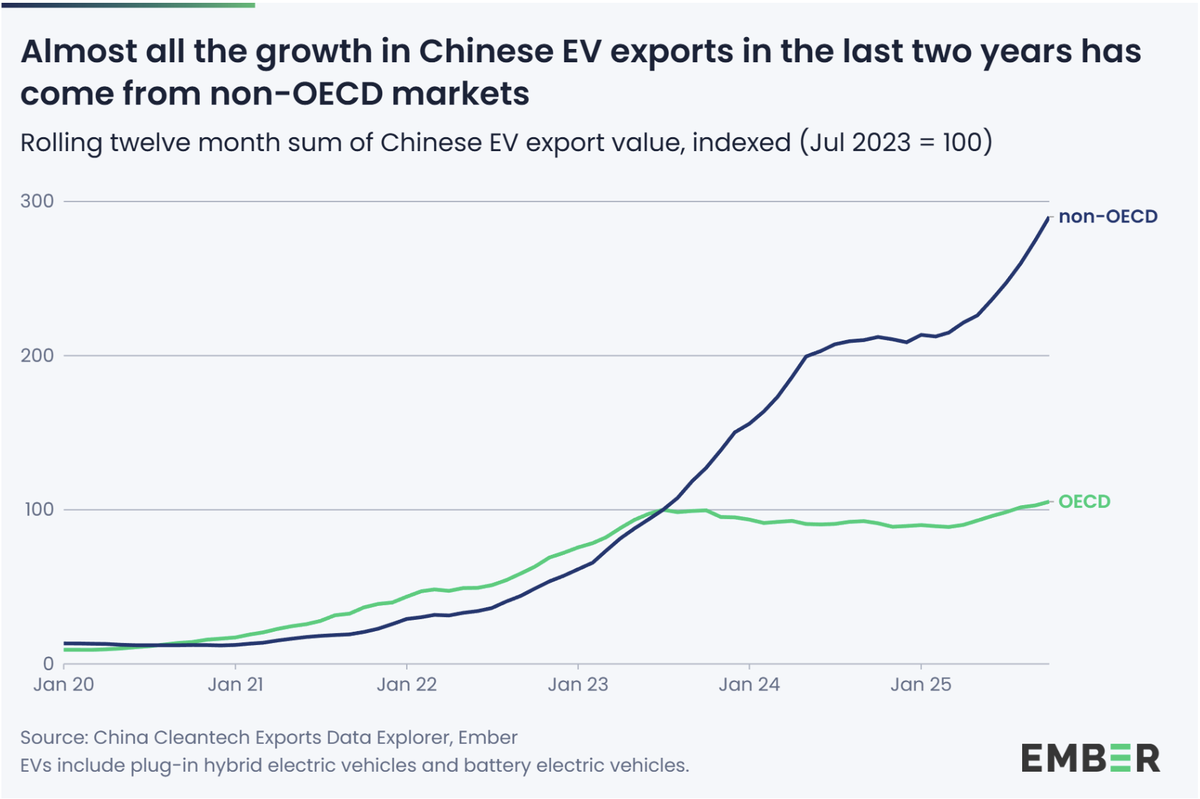

Chinese electric vehicles are reshaping global markets

A key driver of growth is also the supply side shift. Since mid‑2023, virtually all of the increase in Chinese electric‑vehicle exports has come from markets outside the OECD. Export value to these countries has almost tripled, while exports to OECD nations have grown only marginally:

The biggest buyers in 2025 include Brazil, Mexico, Indonesia and the United Arab Emirates.

From an ESG perspective this is crucial: more affordable electric vehicles enable faster adoption even in price‑sensitive economies. The report also debunks the common myth that electric vehicles only make sense in countries with a clean energy mix.

Because of their far higher efficiency—electric vehicles use roughly 80 % of the energy supplied, whereas internal‑combustion engines lose up to 80 %—fuel consumption is reduced even where electricity is generated mainly from coal or gas.

Source: Ember (2025), The EV leapfrog – how emerging markets are driving a global EV boom

The assumption that electric‑mobility growth outside Europe and China will remain limited is proving to be wrong.

Emerging markets will account for the majority of new car sales by 2050. Their decisions on infrastructure, regulation and incentives will have a fundamental impact on future oil demand, air quality, and industrial development.

For companies, investors and policymakers, this conveys a clear message – the transition to electromobility is no longer a linear process driven by wealthy nations. It is a global race – and emerging economies are increasingly setting the pace.

Related articles

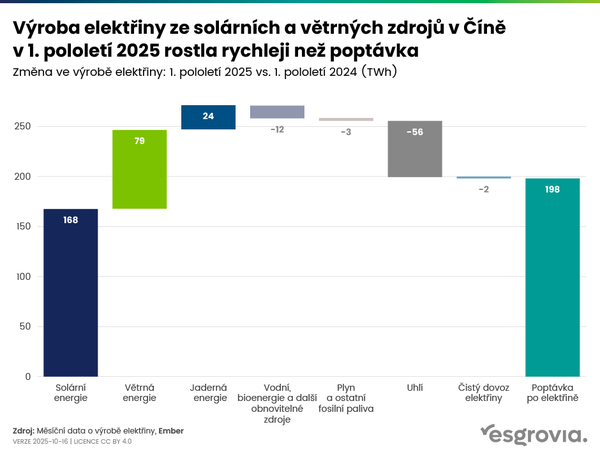

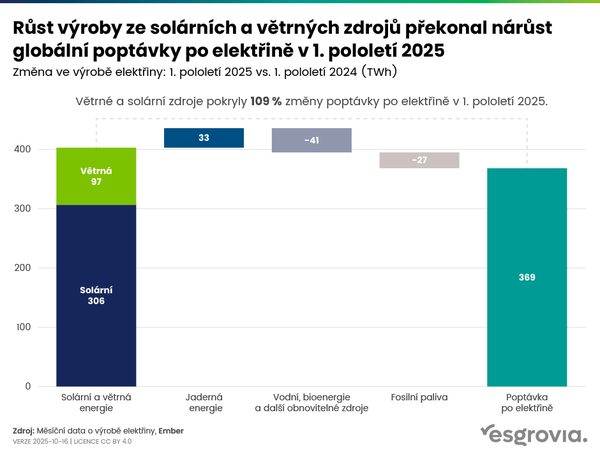

Renewable sources overtook coal as the world's leading source of electricity for the first time

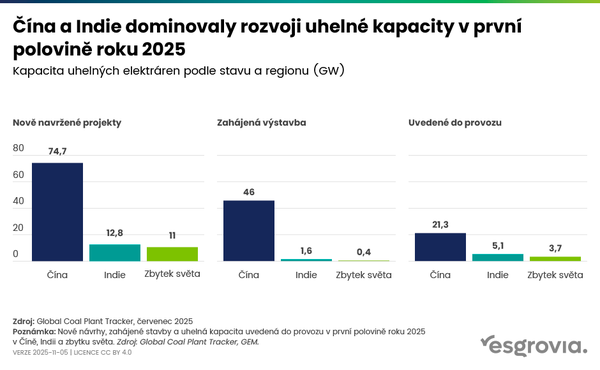

China and India account for 87% of new coal capacity in the first half of 2025

Abundant cheap energy as a determining factor of business sustainability